The EU’s Corporate Sustainability Reporting Directive (CSRD) has already emerged as a global, transformative force in the environmental, social, and governance (ESG) regulatory context. Is your company ready? Our ESG specialists take a look at the risks, challenges and FAQs to prepare your company for the compliance requirements.

What is CSRD?

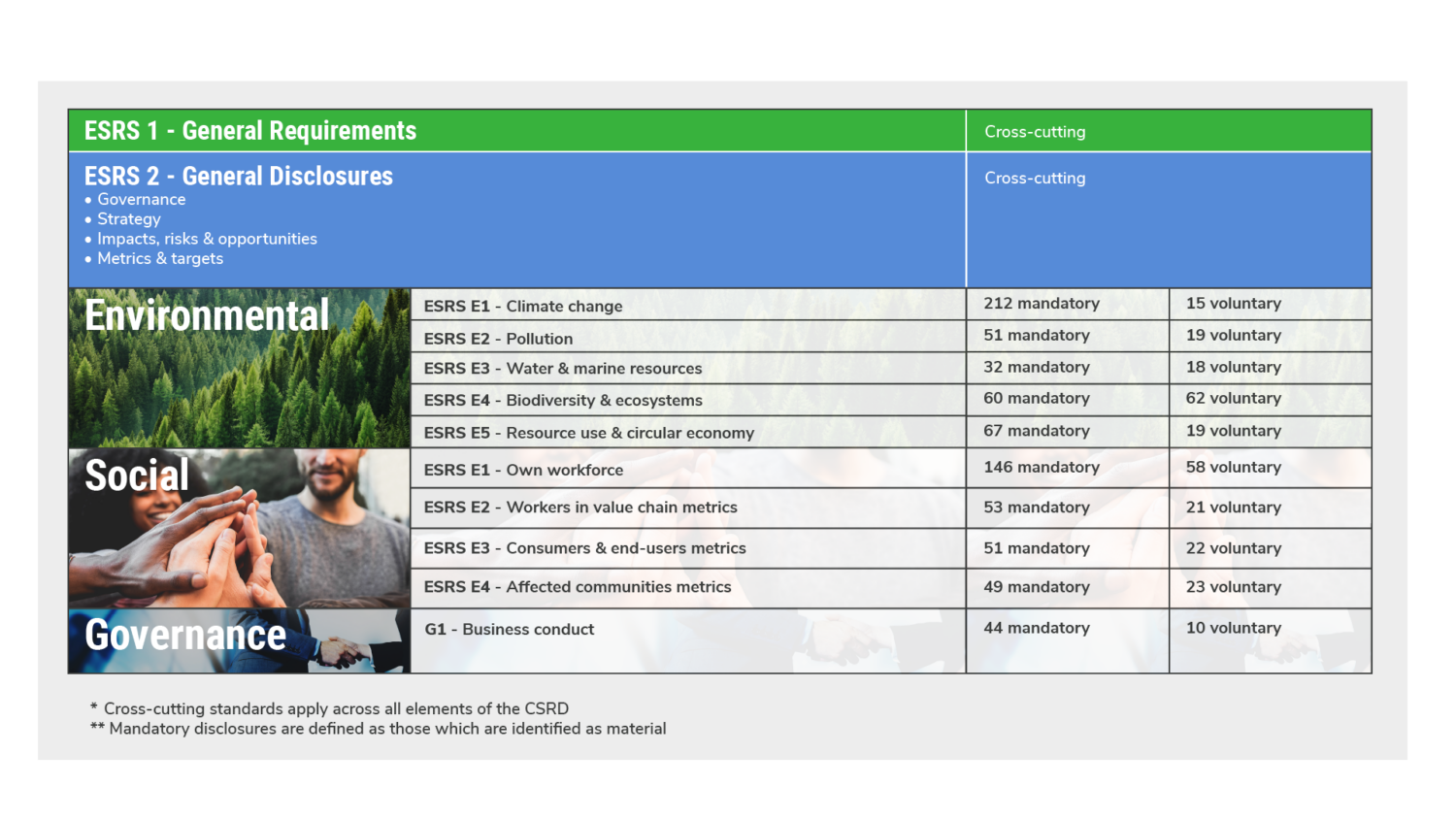

CSRD was passed by the European Commission in December 2022, replacing and significantly extending the existing Non-Financial Reporting Directive (NFRD). Under the new legislation-approximately 50,000 companies based in the EU and an estimated 10,000+ non-EU based companies will be required to start reporting on the sustainability-related impacts, risks and opportunities material to them over the next 5 years. Some organisations will be obligated to disclose on CSRD as early as the beginning of 2025 on their FY2024. This means that by then, companies will need to have understood their company ESG footprint, conducted a double materiality assessment, and developed a report. This has been particularly challenging for many companies as the CSRD double materiality assessment often requires consideration of up to 82 disclosures and 1,144 data points in the reporting standard. These data points span the topics of Environmental, Social, and Business Conduct and require firms to consider impact and financial materiality in their current and forecasted state

Who does the CSRD apply to?

- Large corporates which meet two of the three following conditions:

- €50 million in net turnover

- €25 million in assets

- 250+ employees

- Listed SMEs (LSMEs) – these organisations can adopt simplified standards

- Non-EU undertakings with a turnover above €150m in the EU

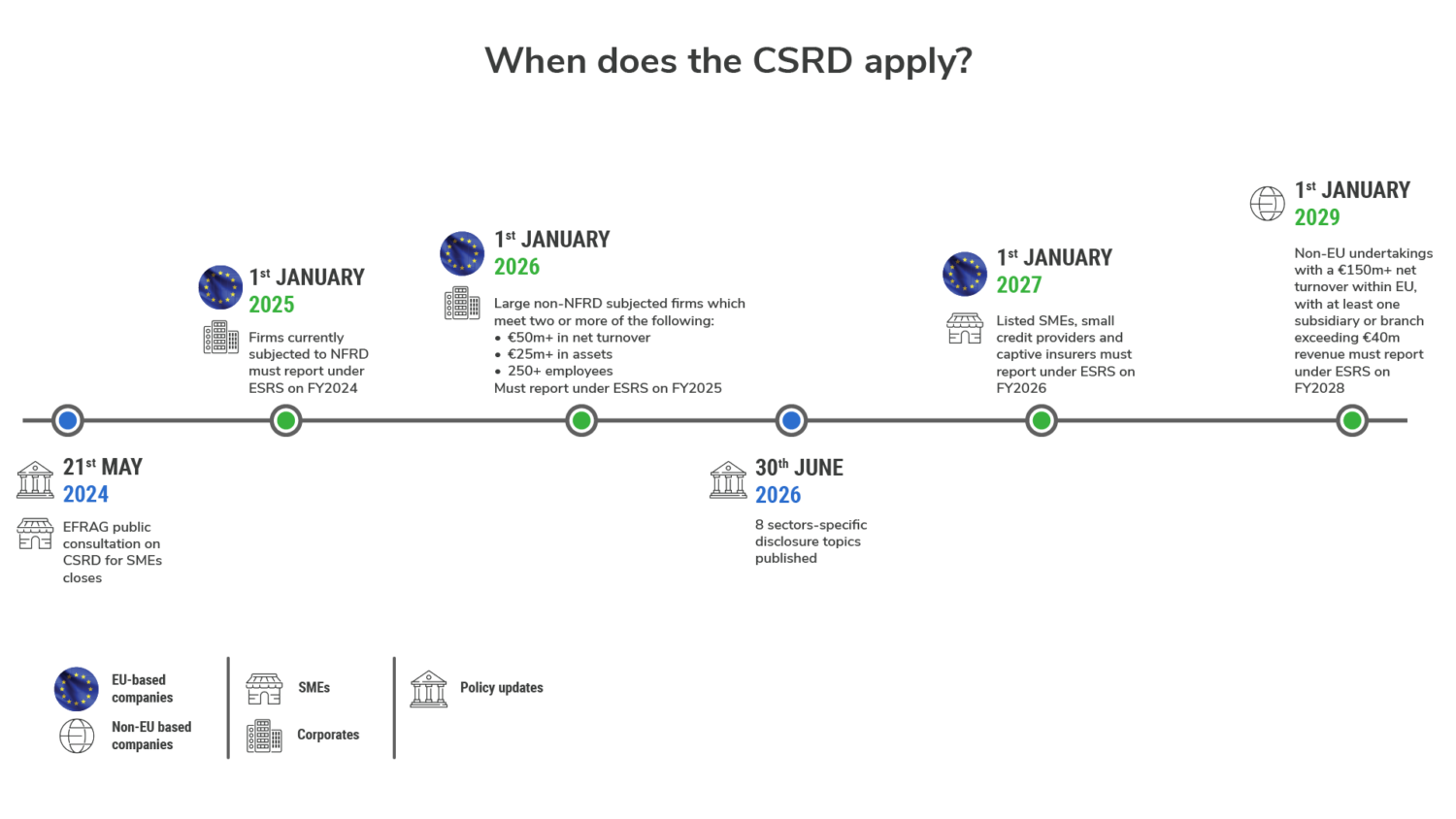

Although the largest organisations are already preparing to report for CSRD in 2025 on their FY2024, the number of organisations affected by mandatory elements of the reporting requirements are being phased in over time.

Risks

- Penalties

All EU states will enshrine the CSRD into national law by the end of 2024, each deciding punishment for non-compliance. Punishments will be severe, set against a backdrop of comprehensive EU green policies. France is the first country to transpose the CSRD, where corporate directors must pay up to €75,000 for non-compliance and face up to five-years imprisonment for obstructing external auditors.

- Reputation / Stakeholder Relationship

Poor quality of data can lead to inconsistencies and inaccuracies in the report leading to loss of stakeholder trust. This may appear as greenwashing which can be picked up by NGOs and cause irreparable damage.

- Investor Confidence

Alongside neighbouring policies such as the EU Taxonomy, the CSRD facilitates confidence between companies and investors where ESG markets are currently unregulated. Insufficient engagement with CSRD requirements signals to investors that organisations are not taking advantage of sustainability-related opportunities, and paying undue consideration to risks. This will spark divestment and restrict access to capital, particularly in the long-term.

Challenges

Understanding where to start and CSRD readiness:

Companies obligated to report on CSRD will have to conduct a double materiality assessment regardless of how advanced they are in their ESG journey. This means that some organisations will need to start from the very beginning by mapping the company’s ESG footprint, hotspots and impact.

Double Materiality:

Firms will have to adopt EFRAG’s double materiality assessment which will be resource intensive and complex. How to conduct, report on and track performance using a double materiality assessment framework is complex and must be understood imminently.

Under CSRD, materiality is established through two dimensions:

- Impact Materiality: a firm’s direct (operational) and indirect (value chain) impacts, using the ESRS disclosure topics as a framework, over the short-, medium- and long-term.

- Financial Materiality: the risks and opportunities sustainability matters pose to a firm’s financial performance, access to capital, cash flows and more over the short-, medium- and long-term.

Topics may become categorised under both financial and impact materiality.

In-depth data collection:

The depth of CSRD reporting requirements are significantly more rigorous than affected firms current sustainability disclosure practices. Companies must take a granular view to previously unreported topics—often across geographies—and ensure best practice data collection is in place for this, or risk facing penalties. This is both resource-intensive and requires widespread collaboration.

Assessing beyond carbon:

Depending on the double materiality assessment, companies may need to collect datapoints through previously unused metrics such as water intensity and/or reducing negative impacts on value chain workers.

Data assimilation and integration:

Many companies already face challenges in selecting the correct data points and improving data quality, visibility, tracking and main systems and process integration for the ESG metrics they currently collect. The significantly wider range of ESG issues and data points required for ESG exacerbates this challenge and will often require development of a carefully considered data roadmap.

Turning collected data into report-ready formatting:

Once data is collected, companies will need to communicate these findings using the double materiality matrix so that it covers the requirements of EFRAG and communicates outcomes to key stakeholders. This involves being familiar with ESG language and the best practices in ESG reporting.

Gemserv can help you prepare for the compliance requirements

With limited time to prepare for the ambitious deadline, we can help you with your sustainability strategy for the CSRD by breaking down the complex process into manageable steps.

Each CSRD report must also be subjected to an external audit, where undertakings explain how and why data and KPIs were collected and reported on. The auditor’s methodology must also be disclosed. A CSRD report must be submitted digitally.

We work with our clients in the UK, EU and internationally advising on:

- ESG Advisory, Sustainability Reporting and Net Zero Roadmaps

- Supply Chain Decarbonisation Strategy

- Circular Economy Strategy

- Workforce and Supplier Engagement and Corporate Social Responsibility

- Supply Chain Emission Reduction

Meet your ESG specialists

Contact Us

If you would like to know more about the Corporate Sustainability Reporting Directive and how it affects you and your business, please complete our contact us form and someone will get back to you shortly.